Some Of Pvm Accounting

Some Of Pvm Accounting

Blog Article

The Facts About Pvm Accounting Revealed

Table of ContentsPvm Accounting for BeginnersSome Ideas on Pvm Accounting You Should KnowThe Only Guide to Pvm AccountingGetting My Pvm Accounting To WorkHow Pvm Accounting can Save You Time, Stress, and Money.How Pvm Accounting can Save You Time, Stress, and Money.

Guarantee that the accountancy process conforms with the regulation. Apply required building audit requirements and procedures to the recording and reporting of construction activity.Interact with numerous funding companies (i.e. Title Business, Escrow Firm) regarding the pay application process and requirements required for repayment. Help with executing and maintaining inner economic controls and procedures.

The above statements are meant to define the general nature and level of work being carried out by people appointed to this category. They are not to be interpreted as an exhaustive checklist of obligations, responsibilities, and skills called for. Workers may be called for to carry out responsibilities outside of their normal duties every now and then, as needed.

The 15-Second Trick For Pvm Accounting

You will aid support the Accel team to make certain shipment of successful on schedule, on spending plan, projects. Accel is looking for a Building Accountant for the Chicago Office. The Building and construction Accountant carries out a selection of accounting, insurance policy compliance, and job management. Works both separately and within details departments to maintain economic documents and make certain that all records are maintained existing.

Principal responsibilities consist of, yet are not limited to, handling all accounting functions of the business in a prompt and exact fashion and providing reports and routines to the business's certified public accountant Company in the preparation of all financial statements. Makes sure that all audit procedures and functions are handled properly. In charge of all financial records, pay-roll, financial and day-to-day operation of the bookkeeping feature.

Prepares bi-weekly test equilibrium reports. Functions with Job Managers to prepare and post all month-to-month invoices. Processes and issues all accounts payable and subcontractor repayments. Creates monthly recaps for Workers Compensation and General Obligation insurance policy costs. Produces month-to-month Task Cost to Date records and dealing with PMs to fix up with Task Managers' budgets for each job.

More About Pvm Accounting

Efficiency in Sage 300 Building And Construction and Property (formerly Sage Timberline Office) and Procore construction monitoring software program an and also. https://businesslistingplus.com/profile/pvmaccount1ng/. Must additionally be proficient in other computer system software systems for the preparation of reports, spread sheets and various other bookkeeping evaluation that might be called for by management. construction taxes. Need to possess solid business abilities and ability to prioritize

They are the financial custodians who make certain that building and construction projects remain on budget, abide by tax obligation Website laws, and maintain financial transparency. Building and construction accountants are not just number crunchers; they are strategic partners in the building process. Their key role is to handle the economic aspects of building and construction projects, ensuring that resources are allocated efficiently and financial dangers are lessened.

The 9-Minute Rule for Pvm Accounting

By keeping a limited grip on project financial resources, accounting professionals help prevent overspending and economic problems. Budgeting is a keystone of successful building and construction projects, and building and construction accountants are crucial in this regard.

Browsing the complicated internet of tax laws in the building industry can be tough. Construction accounting professionals are well-versed in these guidelines and ensure that the job abides by all tax obligation needs. This consists of handling payroll tax obligations, sales taxes, and any other tax obligation responsibilities details to building. To master the function of a building accounting professional, people need a solid academic structure in accounting and financing.

In addition, certifications such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Sector Financial Specialist (CCIFP) are extremely related to in the market. Working as an accountant in the construction industry comes with an unique set of challenges. Construction jobs commonly entail limited target dates, altering policies, and unforeseen expenses. Accountants should adapt rapidly to these challenges to keep the project's monetary wellness undamaged.

See This Report about Pvm Accounting

Professional accreditations like certified public accountant or CCIFP are additionally very advised to demonstrate competence in building and construction accounting. Ans: Construction accounting professionals create and keep an eye on budgets, identifying cost-saving possibilities and guaranteeing that the project remains within budget. They additionally track costs and forecast monetary needs to stop overspending. Ans: Yes, building and construction accounting professionals handle tax conformity for construction tasks.

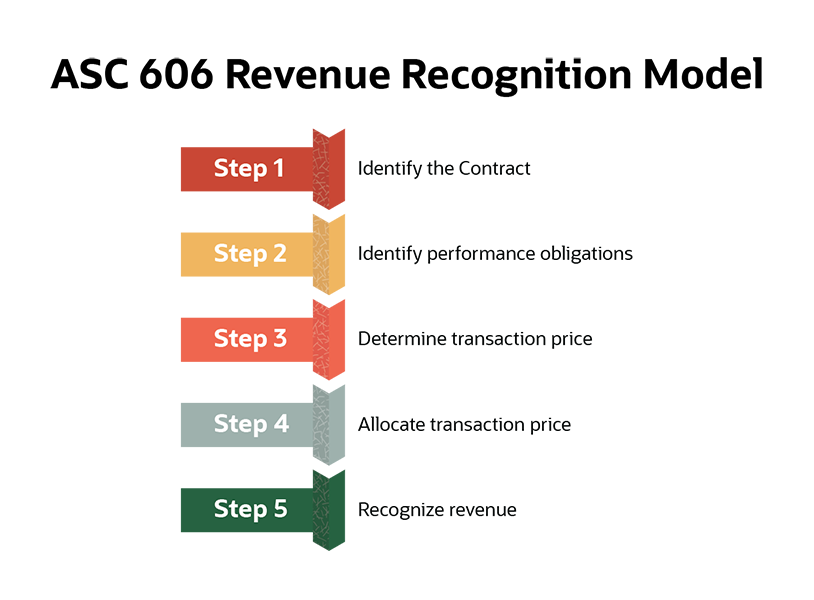

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make hard options amongst lots of monetary options, like bidding on one project over an additional, choosing financing for products or devices, or setting a job's revenue margin. In addition to that, construction is an infamously unpredictable industry with a high failure rate, sluggish time to settlement, and inconsistent capital.

Production involves duplicated procedures with easily identifiable prices. Manufacturing calls for various procedures, materials, and devices with varying costs. Each task takes area in a brand-new location with differing site conditions and unique obstacles.

An Unbiased View of Pvm Accounting

Resilient partnerships with suppliers reduce negotiations and boost performance. Inconsistent. Constant use of various specialty service providers and providers influences efficiency and money circulation. No retainage. Settlement gets here in complete or with regular repayments for the full contract amount. Retainage. Some portion of payment might be held back till project completion even when the contractor's work is ended up.

While traditional producers have the advantage of regulated environments and maximized manufacturing procedures, building firms should regularly adjust to each brand-new project. Also rather repeatable projects require adjustments due to website conditions and other aspects.

Report this page